It is a great time for selling a house (fast) in Connecticut

Back in May, we took a look at the Connecticut Real Estate Market (through April, 2020) and the effect of COVID. This was a review of the Median Sales Price and how it increased in Connecticut despite COVID. As we rolled into the month of May, there was a curiousity as to whether or not the trend (increase in median price value) would continue. It did. Taking into account all home sales across Connecticut, since January, home (price) values have increased month over month. Right now, selling a house in Connecticut is fast. Whether sold to a retail buyer or investor – home sales are moving fast. And prices are going up.

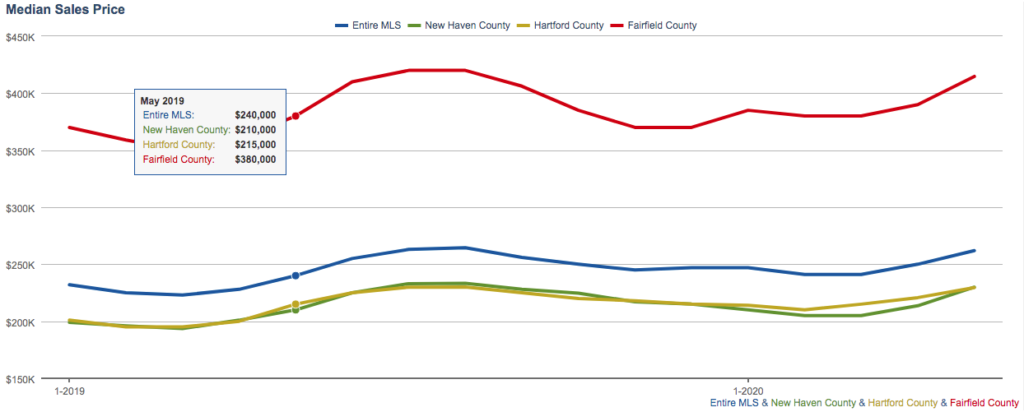

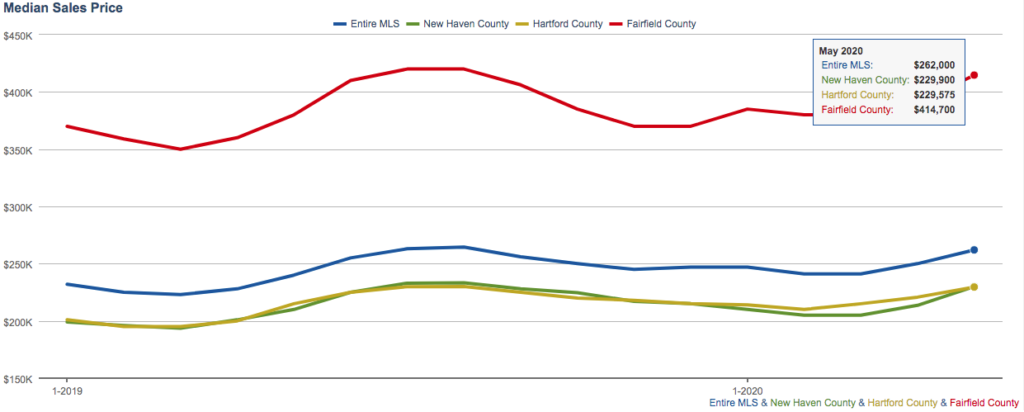

Here’s a look at a year-over-year comparison. In May of 2019, across the New Haven, Hartford and Fairfield counties you can see that the median price values have increased 5% when compared to May of 2020. What’s interesting is that despite the impact of COVID, buyers were still out in force and home values have steadily improved.

Current Real Estate Market Activity

While home price values continue to increase (as they have steadily for years), what we are seeing is a direct correlation to the available inventory and the continuance of low mortgage rates. A key indicator in the market activity is the available supply as well as the days on market statistic. What is encouraging is that our inventory levels (for Connecticut) are starting to rebound a bit. But, over the past few years, inventory continues to be a challenge. As such, the demand for quality homes will continue to increase. And, when compounded with the low interest rates, buyers will be more willing to pay near full list price when they feel the competition of other buyers creeping in with each passing day, week or month.

The Effect of COVID – Has it Passed?

For many, the effect of the COVID pandemic created an improved real estate market. Few buyers should have signaled a shift from a seller favored market (for pricing), but the smaller buyer pool was offset by the (even) smaller supply of housing. What we have seen over the past few months is a shift in qualified buyers paying near full, full or above list price for housing. Overall, the median percentage of list price has been 98.2%. This is consistent with the peak period in 2019. And compared to 2017, it is nearly 1% more.

What does this all mean?

For starters, the convergence of low interest rates and reduced supply is driving buyers into the arms of sellers and with little negotiating room. Yes, there are houses selling well below the list price. And yes, there are homes that are sitting for extended periods with multiple price reductions during the holding period. But this is the median value so those differences are being factored into the percentage. So, has the COVID effect passed? Maybe. Some analysts believe we are heading towards a buyer favored market. Some believe this will be short-lived. But it’s too early to say whether or not the COVID concern is “behind us” for the real estate market. (Here at GLG Homes, we don’t think it’s passed…not even close.)

What about the Investor buyers?

As real estate investors, we look to buy single, multi-family, and commercial properties. Our goal is to buy those properties for the fair market value of that specific property (when compared with equivalent properties that have sold), invest capital into the property and then either resell it or hold it for income generation. But many in the real estate investing community just went dark. The COVID period put a lot of organizations on their heels. Maybe it was a lack of liquidity. Or, maybe they relied solely on certain types of lenders (e.g. hard money lenders) who were unable to provide loans due to being over leveraged (themselves). Then again, they may have just taken a breather waiting to see how the market rebounds. Who knows.

What it is has done is opened doors for many first time homebuyers looking to purchase a home below market value. These first time homebuyers can benefit from a lack of competition as long as the house doesn’t require significant work with a rehab (e.g. 203k) loan. Unfortunately, many lenders had to pause those rehab loans due to the market instability. We anticipate the investor market will rebound in short time. But for now, sellers with a distressed or semi-distressed home (more cosmetic than repair needed) may find that buyers are harder to come by due to the reduction in rehab loan programs. For those sellers, the real estate investor is still their best bet. And, given that this group has shrunk, there is competition for buying so these sellers may find a little more negotiating room.

What’s up next?

For GLG Homes, we are continuing to offer our purchasing program(s) to sellers. We all know there is more than one way to solve a problem and real estate is no different. For those sellers who are unsure about selling or are struggling to sell, we have options that can help and benefit every situation.

And, as far as the market analysis goes, we will continue to review this over the summer.

Questions? Comments? Thinking about selling your home? Feel free to reach out.

Thanks,

g.